Every vertical SaaS company faces the same challenge: balancing growth with trust. As you embed payments directly into your platform, how you manage risk and fraud detection isn’t just a compliance concern – it’s a strategic choice that shapes your user experience.

When risk management becomes part of your embedded payments experience – not a barrier to it – everything accelerates. Onboarding moves faster. Merchants activate sooner. Platforms build lasting trust.

At Payabli, we believe risk is not a cost center – it’s an intelligence layer that fuels confident growth.

Our Pay Ops technology turns that intelligence into a competitive advantage – making risk visible, configurable, and actionable across the entire embedded payments journey, from onboarding to payment acceptance.

From Rules to Models: The Evolution of Risk Management

Most payment fraud detection systems start with static, rules-based monitoring – velocity checks, blocklists, or simple IP/geographic flags. Useful, but blunt. Modern risk management strategies require more intelligence.

Our Pay Ops solutions take that foundation and layers in machine learning–driven risk scoring, contextual policy orchestration, and agentic automation to transform risk from a reactive process into a proactive experience layer.

This proactive approach starts the moment a merchant within your platform signs up. By embedding intelligent risk evaluation into onboarding, SaaS platforms can verify, segment, and activate merchants confidently – minimizing fraud while maximizing flow.

Beyond Transactions: Risk Management Strategies Across the Full Merchant Lifecycle

True risk management extends far beyond authorization. Payabli embeds intelligence into every stage to facilitate continuous protection for platforms that feels seamless:

Onboarding & Underwriting: Dynamically verify business data and flag risk factors in real time. Adaptive pathways fast-track trusted merchants while escalating suspicious cases for review.

Transaction Monitoring: ML-powered scoring synthesizes velocity, geo-location, and behavioral signals into explainable risk scores that dynamically approve, hold, or block.

Payout Controls: Volume-based rules monitor ACH exposure. If payouts exceed thresholds, the system holds funds or triggers review – protecting platforms without disrupting cash flow.

Continuous Merchant Intelligence: Continuous monitoring tracks chargebacks, refunds, and exposure trends. When patterns shift, automated triggers adjust rules or prompt re-underwriting.

Together, these capabilities transform your SaaS platform into a full-lifecycle risk system – one that turns risk management into a competitive advantage by aligning it directly with user experience.

Rules Engine, Reimagined

At Payabli, we’ve built a powerful orchestration engine that allows multiple outcomes – alert, hold, block – for every transaction. Instead of rigid “yes/no” logic, our risk model dynamically adapts to behavior, generating explainable transaction records for every decision.

That same flexibility applies during the merchant onboarding process. Risk signals inform adaptive pathways: fast-tracking trusted merchants for quick approval while automatically escalating suspicious cases for review.

The result? Smarter protection that feels invisible. This is “Risk as UX” in action, providing protection that works quietly behind the scenes.

Customizable Risk & Onboarding Policies

Every vertical SaaS platform operates differently. Payabli lets SaaS platforms define risk and onboarding policies at the organization or merchant level – tightening controls for new or high-risk accounts while allowing flexibility for established, trusted merchants.

This contextual control transforms what’s often seen as friction into a feature. Merchants feel seen and understood, while SaaS platforms maintain the guardrails that keep ecosystems healthy. Risk and experience move in sync.

Make Smarter Decisions with Risk Scores: Context You Can Act On

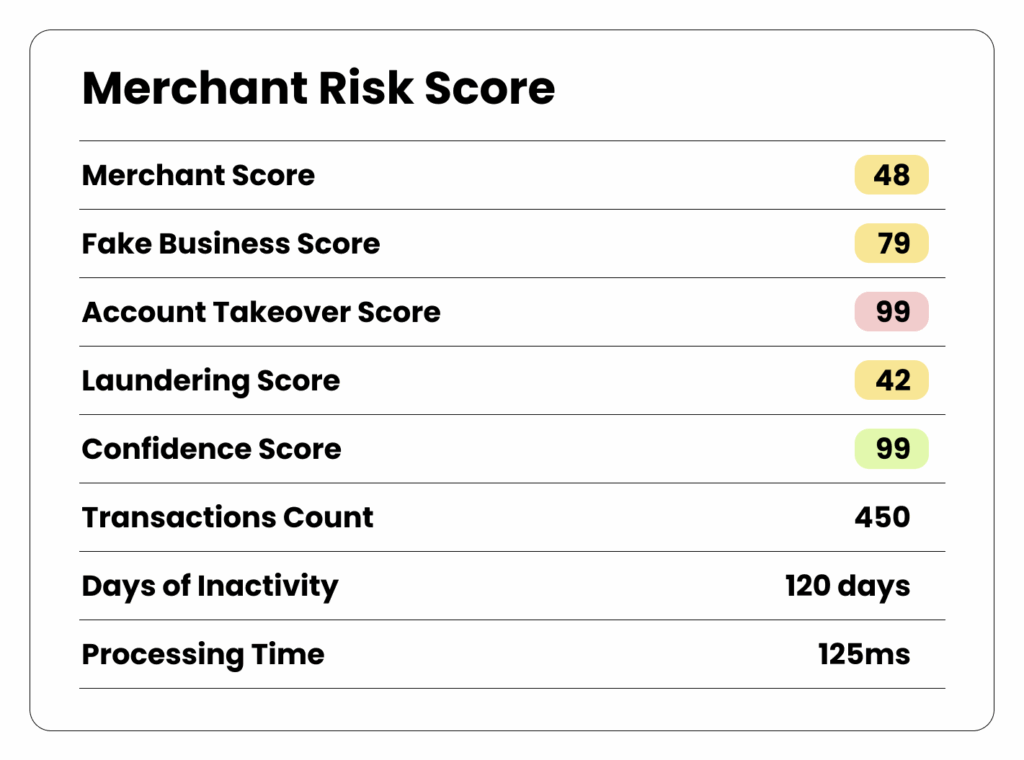

At the heart of our Payment Operations platform (Pay Ops) is our Risk Scoring Model, an advanced payment fraud detection engine that generates merchant scores and per-transaction scores to quantify potential fraud or loss.

This risk scoring approach is built from multiple layers of intelligence:

- Transaction patterns (velocity, frequency, amount anomalies)

- Merchant-level history (chargebacks, refunds, exposure trends)

- Device and location signals (geo mismatch, IP diversity)

- Behavioral and vertical data unique to each merchant’s industry

The result is an explainable, transparent score – not a black box. SaaS platforms can view sub-scores for AML risk, transaction anomalies, and fraud probability, with clear reasoning behind each outcome.

Transparency here is UX. When merchants understand why they’re being verified or approved, it builds confidence and reduces drop-off – turning compliance moments into trust moments.

Today, Payabli’s teams are shadow-scoring all transactions internally – a step toward offering these insights directly to SaaS platforms managing their own exposure and onboarding workflows.

AI-Powered Policy Creation and Triage

Managing risk across hundreds of merchants can overwhelm even the best teams – but when risk intelligence is automated, it becomes part of the experience rather than an interruption.

Payabli’s AI-driven agents continuously monitor and triage fraud alerts in real time. When potential card-testing events occur, these agents:

- Cluster related alerts

- Detect patterns (multiple BINs, IP variations, timing spikes)

- Surface summarized context directly in Slack

- Recommend actions like “hold,” “review,” or “safe to ignore”

This turns a flood of alerts into one intelligent conversation – letting human reviewers focus on what matters most. In practice, that means fewer interruptions, faster decisions, and a more seamless merchant experience from onboarding to payment acceptance.

Building the Next Layer: Risk Management as a Product

In many ways, Payabli has built its own version of Stripe Radar – but purpose-built for vertical SaaS platforms. Because our Pay Ops infrastructure is modular, platforms can decide how deeply to integrate the risk layer:

- Base: Internal risk monitoring and fraud alerts

- Advanced: Per-transaction risk scores and custom rule policies

- Enterprise: Co-managed risk operations and AI-driven triage

Over time, these capabilities don’t just reduce losses – they unlock new revenue. Vertical SaaS platforms can monetize advanced merchant monitoring, loss liability protection, or transaction scoring, using Pay Ops as the engine behind it all.

Why It Matters for Vertical SaaS Platforms

Owning the full payments experience means owning the risk that comes with it – but also the trust it creates. When risk management is designed as part of the user experience, SaaS platforms can:

- Onboard merchants faster with confidence

- Reduce fraud losses without adding friction

- Protect merchants through explainable, real-time risk data

- Automate reviews to keep workflows smooth

- Build trust through transparency and control

- Monetize operational intelligence as a premium service

This is the future of risk management – invisible infrastructure that quietly powers exceptional experiences.

Let’s Build Your Risk Management Strategy Together

The next generation of vertical SaaS platforms will win not just by managing risk – but by embedding it into the user experience. Payabli helps you transform compliance into confidence and risk operations into growth levers. If you’re building the future of embedded payments, we’d love to help. Schedule a demo to start shaping your risk management strategy today.