For Vertical SaaS Platforms powering embedded payments, Ghost Cards are emerging as a powerful solution to an often-overlooked challenge – the Pay Out side of the equation. While many platforms obsess over Pay In optimization—perfecting card acceptance, reducing friction, and maximizing conversion—vendor payouts frequently remain manual, fragmented, and inefficient. Ghost Cards streamline this process, unlocking automation, control, and scalability on the Pay Out side that matches the sophistication of Pay In.

But as platforms scale, this oversight becomes costly.

Fragmented payout processes create friction that frustrates customers and erodes trust:

- Critical payments missed or delayed due to manual vendor setup errors – One data entry mistake means a contractor doesn’t get paid on time, jeopardizing your customer’s relationship with their supplier.

- Card-on-file vendors won’t accept ACH or checks – Some vendors only accept card payments, forcing your customers to maintain multiple payment systems or lose access to preferred suppliers.

- Payment rail mismatch sends checks or ACH to card-enabled vendors – Every mismatch between vendor preferences and your default rails creates friction, delays, and support overhead that drains resources.

These aren’t edge cases – they’re everyday realities that create support tickets, damage customer satisfaction, and leave revenue on the table.

What if you could eliminate these headaches while turning payouts into your platform’s highest-margin revenue stream?

That’s what Ghost Cards make possible.

What Are Ghost Cards?

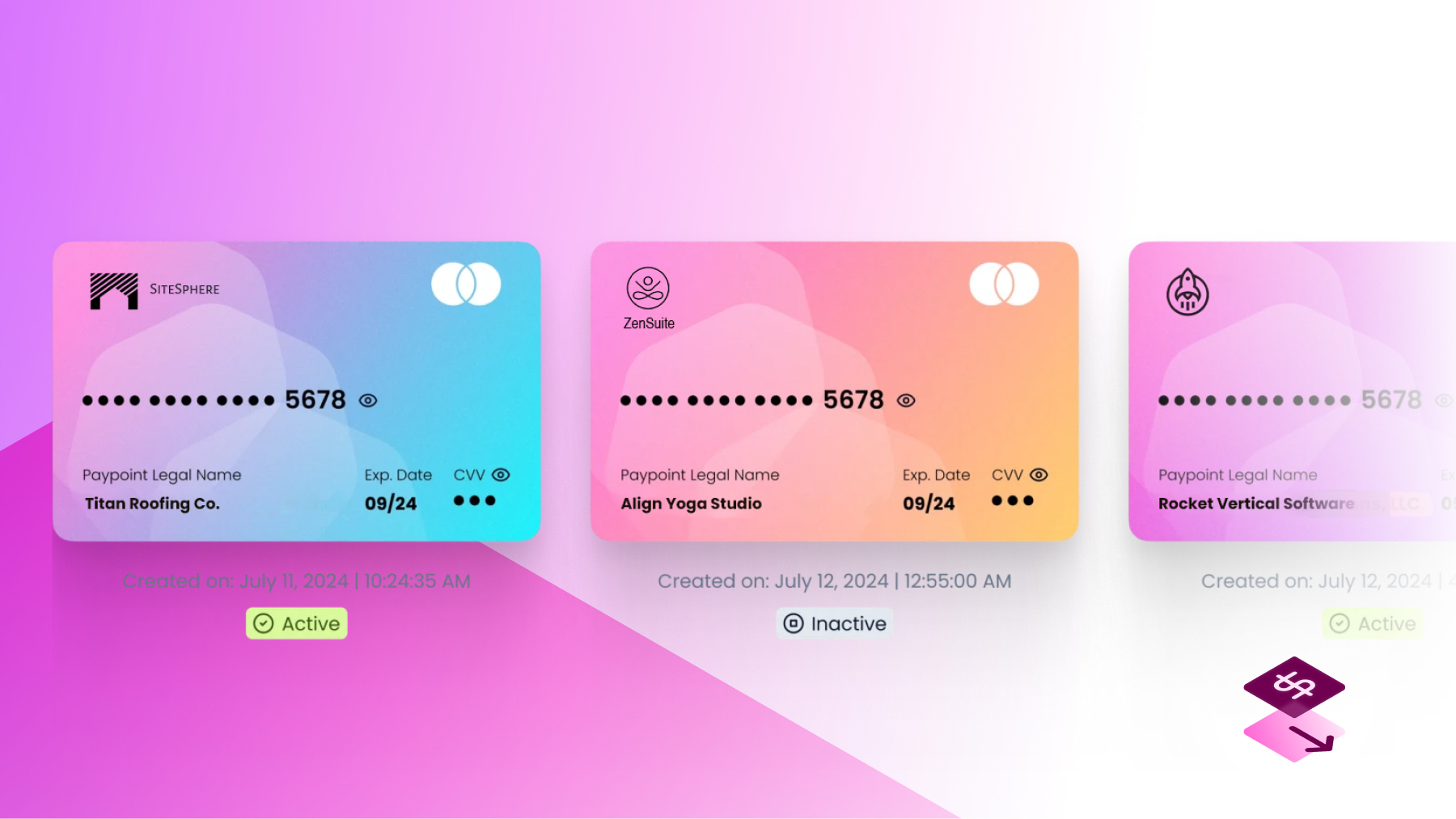

A Ghost Card is a multi-use virtual card issued to a vendor for ongoing payments. Unlike single-use virtual debit cards, Ghost Cards can be tied to specific vendor relationships – making them ideal for recurring invoices, supplier contracts, and repeat service providers.

They function like any traditional credit or debit card – only faster, safer, and fully digital.

In short: Ghost Cards let your platform issue one card per vendor, automating recurring payments while maintaining full control.

Why Ghost Cards Are a Game-Changer

Ghost Cards don’t just simplify how vendors get paid – they monetize the entire payout flow.

Because they operate on card rails, Ghost Cards generate significantly higher interchange revenue than ACH or check payments – often outperforming even your Pay In monetization.

But the advantages go beyond revenue:

- Recurring & Multi-Use – One card per vendor makes paying repeat suppliers simple, automated, and efficient so that a critical payment (like a utility bill) is never missed.

- Configurable Controls – Set spend limits, restrict merchant categories, and control expirations.

- Instant Funding – Credit or good-funds models eliminate ACH delays.

- White-Labeled – Brand every transaction with your platform’s logo.

- Unified Reporting – Full visibility and reconciliation from your dashboard.

With Ghost Cards, platforms don’t just process payments – they control the entire payout experience.

Ghost Cards vs. Virtual Debit Cards

| Category | Virtual Cards (Single-Use) | Ghost Cards (Multi-Use) |

| Usage | One-off vendor payments | Recurring vendor relationships |

| Control | Basic (single transaction) | Advanced (limits, MCC, expirations) |

| Vendor Experience | One card per payment | One card for ongoing payments |

| Reconciliation | Harder to match to invoices | Easier, tied to vendor account |

Ghost Cards extend the capabilities of traditional single-use virtual cards – enabling automation, better visibility, and ongoing profitability.

Who Benefits Most from Ghost Cards

Ghost Cards are ideal for Vertical SaaS platforms serving industries that manage recurring vendor relationships and frequent supplier payments.

Use Cases:

- HOA & Property Management – Pay recurring contractors like landscapers and maintenance crews.

- Healthcare – Streamline payments to repeat suppliers for medical equipment and consumables.

- Education – Issue recurring payments to transportation, IT, and facility vendors.

- Field Services & Construction – Manage ongoing payments to subcontractors, materials suppliers, and rental companies.

- And Many More – Any vertical with recurring vendor relationships benefits from Ghost Cards’ flexibility and control.

By simplifying these recurring payouts, Ghost Cards improve vendor satisfaction while driving consistent platform revenue.

Turn Recurring Payouts Into Recurring Profits

Ghost Cards give SaaS platforms a double advantage:

- They empower businesses with faster, more secure vendor payments.

- They unlock recurring, high-margin revenue from every payout – with significantly higher interchange revenue than ACH or check payments.

Instead of handing off payouts to traditional banks or third-party processors, your platform becomes the hub for every transaction – earning more revenue while delivering a better vendor experience.

With Ghost Cards, payouts aren’t just a back-office process – they’re a growth engine.

Start Monetizing Vendor Payments Today

Ready to own your payout experience and maximize your revenue potential? Book a demo or talk to our team about Ghost Cards and start turning payouts into profit.