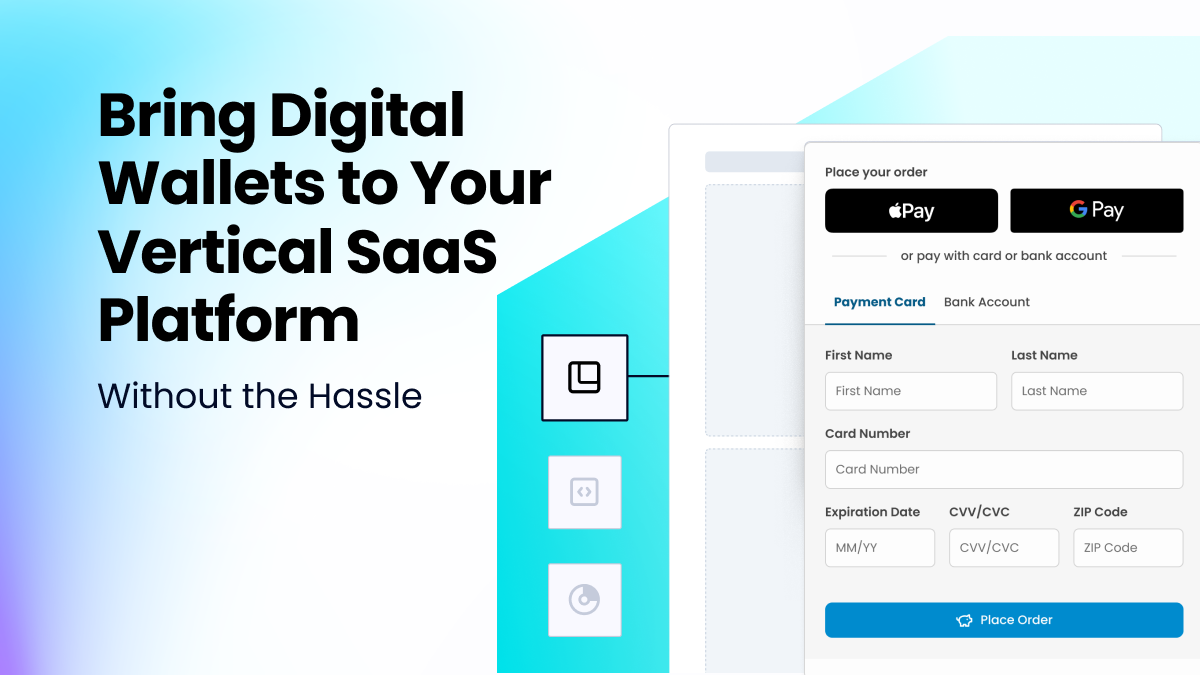

Apple Pay and Google Pay are table stakes. But embedding them into your vertical SaaS stack? That’s where Payabli gives you the edge.

Online checkouts are evolving, and fast. Your SaaS platform’s customers and their end users expect the ability to pay with popular digital wallets like Apple Pay and Google Pay. The question is not whether your platform should support digital wallets. It is about how quickly and easily you can do this, without putting extra work on your team or delaying your roadmap.

Most providers make digital wallet integrations harder than they need to be. Payabli doesn’t.

The Invisible Work of Wallets: Why Most Solutions Fall Short

Bringing Apple Pay and Google Pay to your SaaS platform usually comes with a heavy list of technical requirements:

- Complex key and certificate management

- Manual merchant onboarding

- Integration of encryption libraries

- Custom API work and PCI-level configurations

It’s not just a checklist—it’s an obstacle course.

While others give you the tools and walk away, Payabli handles the entire digital wallet stack on your behalf. As a registered Payment Service Provider (PSP) for Apple Pay and Google Pay, we handle the hard work for you so you don’t need to build, manage, or maintain it yourself.

Think of Payabli as your digital wallet infrastructure-as-a-service—built for scale, speed, and simplicity.

Digital Wallets, the Payabli Way: A New Standard of Simplicity

Payabli is redefining what it means to support Apple Pay and Google Pay for browser-based, card-not-present transactions. Here’s how:

One Step, Platform-Wide Enablement

Activate wallets across all merchants at once, with new merchants automatically onboarded. No extra work required.

Fully Abstracted, Fully Managed

With our low-code digital wallet solution, we handle key management, encryption, tokenization, and certificate handling. This means you or your developer teams don’t have to manage burdensome configurations, libraries, or compliance tasks.

Secure & Compliant by Default

Every wallet transaction is PCI Level 1 compliant, encrypted, and tokenized out of the box. No security shortcuts, no risk of falling out of scope.

Fastest Way to Start Accepting Digital Wallets

Start accepting wallet payments in under one week with Hosted Payment Pages – no code required. Want a more integrated experience? Our low-code Express Checkout UI with embedded components gets you live in as little as two weeks.

Built-In Advantage: What PSP Status Means for You

Most solutions require the SaaS to own and operate the technical plumbing for Apple Pay and Google Pay. This includes acting as the Merchant of Record, registering for digital wallet programs, and managing cryptographic keys—none of which are fast or easy.

Because Payabli is a registered PSP of Apple Pay and Google Pay, we handle this for you.

No waiting on approvals. No merchant-specific configurations. No friction.

Your team stays focused on building products. We take care of the rest.

Get Started Today – Deliver the Checkouts Your Merchants Expect

Enabling digital wallets shouldn’t feel like a build-your-own adventure. With Payabli, you can deliver the modern, embedded payment experience your merchants want—fast, securely, and without any technical overhead.

Contact our team today to get started — or explore our developer docs to see how easy integration can be.