Most Software companies find Payment Processing an opaque, confusing, and distracting business.

For instance, our Software partners often find Payments economics extremely murky. We’ve been in the shoes of our Partners and recognize that learning payments the “hard way” is not fun. As a result, we are passionate about shortening the learning curve for our Partners. Firstly, we want our Partners to truly understand how they are deriving their payments revenue. Secondly, we want them to understand how to maximize their payments revenue. Lastly, we want our partners to leverage Payments to enhance their product and customer experience.

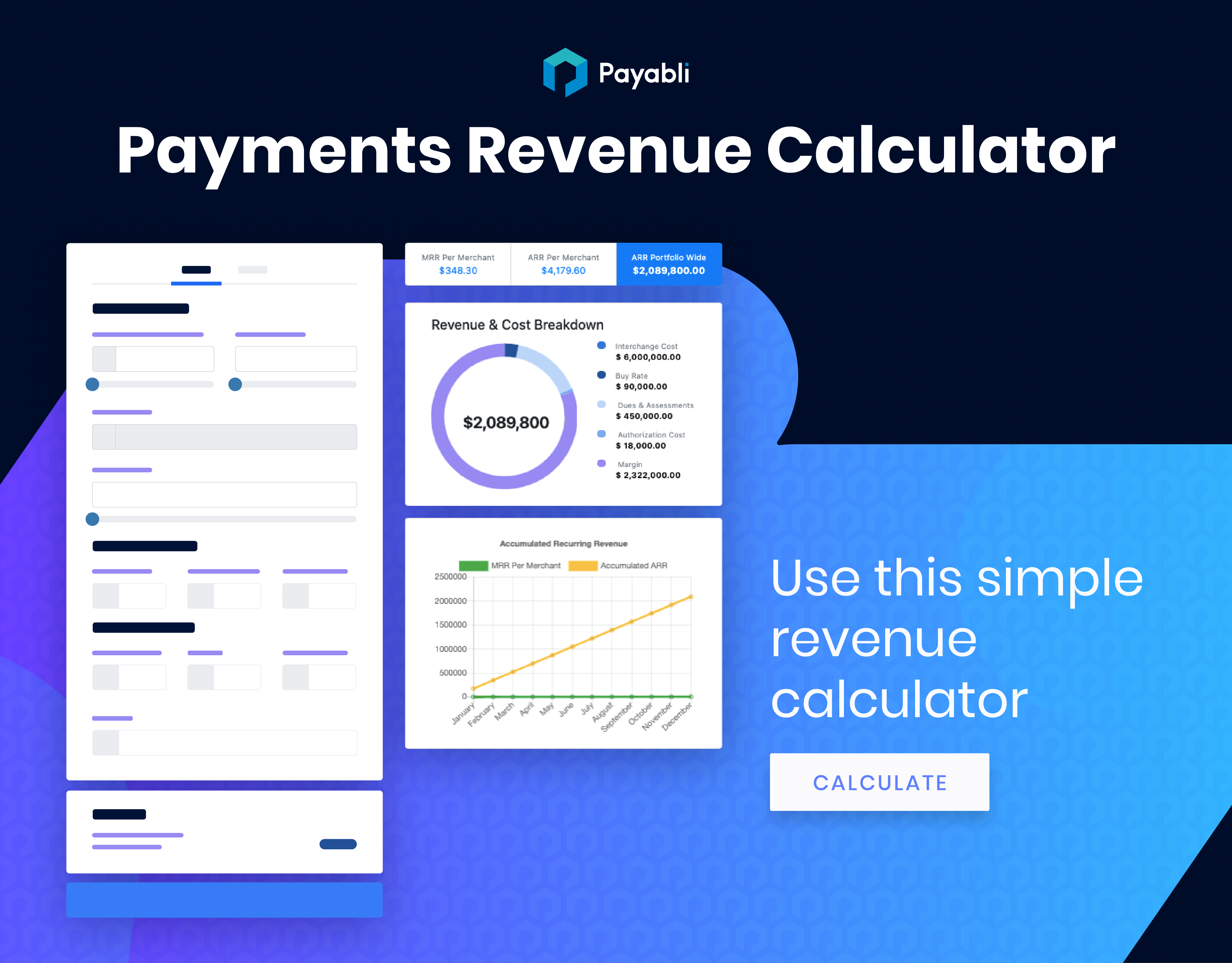

Here’s a simple heuristic to help Software companies calculate their latent payments revenue. This first iteration is for receivables, or what we call “Pay-In”. Stay tuned for expanded versions that incorporate different pricing strategies, interchange optimization, convenience fee scenarios and more. We’ll also be releasing a Payouts calculator showing economics for Card Issuing, Push to Card, Real Time Payments, ACH and more.

Give it a whirl and send us your feedback!

Variable Descriptors

- Monthly Processing Volume: The approximate amount of Credit Card volume ran per merchant. ACH and other payment types will be coming in V2!

- # of Transactions: This is the Average number of Credit Card transactions per merchant per month.

- Rate Charged: You can employ various pricing models and strategies for different use-cases and scenarios, however we’re sticking to a simple Flat-Rate pricing model for this calculator.

- Auth Fee Charged: The Auth Fee, short for Authorization Fee, is a per transaction fee charged to the end merchant. Market rate is usually between $.10 and $.30.

- Revenue Shared: What’s your revenue split with your payments “backbone”? Our goal is to make payments a primary revenue driver. Contact Sales for details on our lucrative rev-share programs!

- Interchange Rate: Interchange is a “wholesale” cost of processing charged by the Card Issuing Bank. There are hundreds of Interchange categories influenced by various factors. There’s a lot of great articles online detailing Interchange, but we personally like this one from CardFellow.

- Buy Rate: Buy Rate is a loaded term. In this calculator we define it as the discount percentage markup that you pay to your payments backbone. Buy Rates are covered before they start to share revenue with you. Because of this incongruence we’re not huge fans of Buy Rates.

- Dues & Assessments: Dues & Assessments are also “wholesale” costs charged by the Card Associations, however we’re limiting this to Assessments for simplicity. There’s a number of other nominal fees within this category.